Floating offshore wind is an innovative power-generating technology that has the potential to disrupt the global energy balance. Learn about its benefits and challenges.

Table Of Content

- Content

- ‘Floaters’ Buoyant on Wind Technology Advancements

- Booming Investment and Interest in Floating Offshore

- Conclusion

- FAQ

- You May Also Like

- External Links

This year has seen a flurry of activity in the field of floating offshore wind, suggesting that the pipeline for this formerly dormant area of wind technology may at last be starting to expand after years of stagnation. At the moment, floating offshore wind only makes up 0.1% of all wind installations. However, according to the Global Wind Energy Council (GWEC), new discoveries suggest that by 2030, floating offshore wind could reach 16.5 GW, making up 6.1% of all wind installations around the world.

According to a study published in March by the global wind energy conference, floating offshore wind has successfully completed the demonstration and trial phases of its roadmap to commercialization and is now firmly in the “pre-commercial” phase. During the last decade, “MW-scale floating technologies have been evaluated via demonstration and pilot projects in both Europe and Asia,” the report said.

After the first megawatt-scale offshore wind turbine was installed in Norway in 2009, the sector has seen a number of “firsts,” such as the 2017 connection of the 30-MW Hywind Scotland wind farm in the UK, which included five Siemens Gamesa Renewable Energy (SGRE) 6-MW turbines. The 25 MW WindFloat project went live in May of 2020, just off the coast of Viana de Castelo in Portugal. The 50-MW Kincardine project in Scotland went operational in October 2021 using a Principal Power Windfloat platform and five Vestas V164-9.5 MW turbines (Figure 1). And in December 2021, China linked the world’s first “typhoon-resistant” floating offshore wind turbine, the 5.5 MW Sanxia Yinling Hao, to the grid.

In October of 2021, one of the biggest floating wind farms in the world, the 50-MW Kincardine Offshore Windfarm, began full operations. The project includes five 9.5-MW Vestas V164 turbines and one 2-MW Vestas V80 turbine, each erected on WindFloat semi-submersible platforms developed by Principle Power, and is located 15 kilometers off the coast of Aberdeenshire, Scotland, at sea depths varying from 60 meters to 80 meters. Cobra Wind, which is part of the Cobra Group, was in charge of all parts of the project, from planning and design to building and testing.

“Larger first-of-a-generation initiatives,” as GWEC put it, are increasingly becoming the center of attention. However, we anticipate yearly installations to exceed 1 GW by 2026, a benchmark that fixed offshore wind achieved in 2010. This marks the beginning of the commercialization of floating offshore wind. South Korean, Japanese, Norwegian, French, and British developments will support rising installation rates and larger project sizes beginning in 2026, the group predicts.

GWEC found many drivers supporting the sector’s expansion. Most notably, we have a chance to reap hitherto unrealized benefits as the globe works to quickly decarbonize. In water depths greater than 60 meters (m), it was claimed, there exists the potential for 80% of the world’s offshore wind resources. “Floating wind might assist in producing socio-economic advantages like employment and most critically involve the oil and gas business to complete a seamless energy transition,” the researchers write. “For example, they could bring their knowledge in foundation building and unique talents in executing major engineering projects into offshore wind while re-skilling people who may be displaced from the oil and gas industry.”

According to the projections of the Global Wind Energy Council (GWEC), between 2021 and 2025, Europe will be home to as much as 68.2 percent of all new floating offshore wind installations. Asia and North America will follow in third and fourth places, respectively. Yet, in the latter part of this decade, Asian nations are expected to more than quadruple their worldwide market share.

‘Floaters’ Buoyant on Wind Technology Advancements

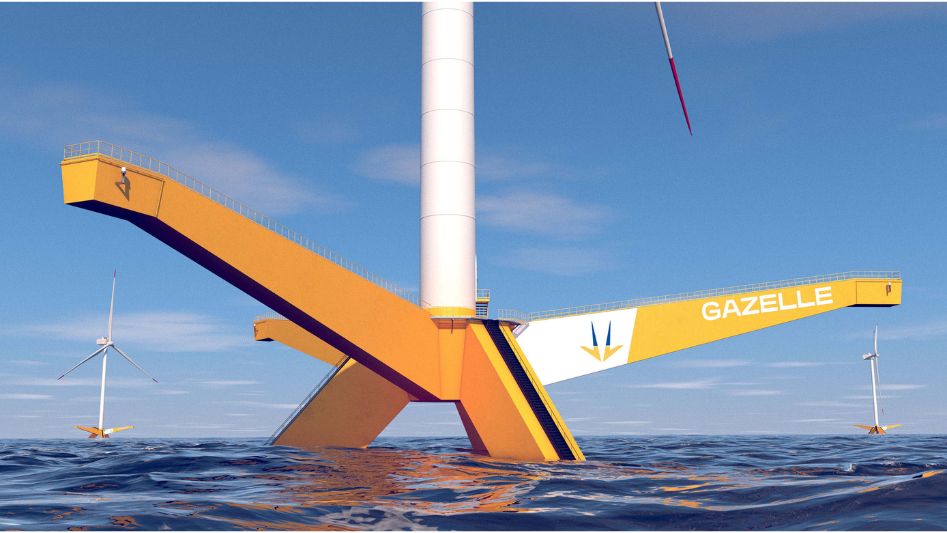

The attention and funding of some of the biggest energy companies in the world have also helped kickstart innovation. Semi-submersible floating structures, like those used in the Kincardine project, have been the primary workhorses of the floating offshore sector, but knowledge of the oil and gas industry might help improve alternative “floaters,” such as deep-water floating spars, tension-leg platforms, and barge types.

However, it is important to note that there is currently no silver bullet for floating wind. “The choice of a floating foundation will be influenced by a number of variables, including geography, political need, localization potential, existing infrastructure, and turbine design,” GWEC added. Floating wind has fewer installations than fixed-bottom wind, so there is less time to perfect operations and maintenance (O&M) solutions for floating turbines. This could end up favoring certain designs when cutting costs is a priority.

Third, this diagram shows numerous variations of wind turbines. Monopiles (which can only be used in shallower than 50 meters of water), four-legged jackets, twisted jackets, tension-leg floating platforms, semi-submersible platforms, and spar buoys are shown from left to right. From Josh Bauer/NREL

According to GWEC, the industry is expecting construction and O&M innovations as the market develops, especially to carry out operations in port or in protected seas that might make use of diverse boats. According to GWEC, new technology and products are expected to provide better mooring and anchoring solutions, longer maintenance schedules, deep water substations, and dynamic cabling.

Nonetheless, in order to realize the massive growth it anticipates, the floating offshore sector must overcome a number of severe technological and business obstacles. Water depth, turbine integration, cost, and performance continue to be important problems, in addition to ensuring port access and the simplicity of production. GWEC said it doesn’t expect a major consolidation of the industry, but it did say that platform providers would need developer partners to be able to offer the first cluster of commercial projects “or be convinced that they can bring significant innovation and cost reduction to be considered as part of a second generation of platform possibilities.”

Meanwhile, the floating offshore sector has some of the same issues that plague the overall wind business. The Global Wind Energy Council’s (GWEC) Global Wind Report 2022, published in April, noted an optimistic growth trend for wind energy but also highlighted policy-related risks. Emerging difficulties include infrastructure and connectivity worries and societal acceptability. Finally, the report said that project developers are under stress due to market disruptions, including rising freight costs and commodity prices.

Booming Investment and Interest in Floating Offshore

Despite these obstacles, new evidence points to a major uptick in the floating offshore project pipeline. The U.S. Bureau of Ocean Energy Management (BOEM) has designated three Pacific Ocean call areas offshore Oregon this year alone, and the California Energy Commission has approved renovations to the Port of Humboldt Bay to facilitate offshore project development in regions north of Morro Bay and off the coast of Humboldt County. The Redwood Coast floating wind farm is one of the possible projects. It will have a capacity of 150 MW and is being built by Principle Power, Aker Offshore Wind, H.T. Harvey & Associates, Herrera Environmental Consultants, and Ocean Winds North America as part of a partnership.

TotalEnergies has also lent support to the 1-GW Castle Wind floating offshore wind project, which aims to begin operations in the Morro Bay area between 2025 and 2027. In April, Washington-based Trident Winds sent BOEM an unsolicited lease for a commercial lease that could house the 2-GW Olympic Wind project, which would be the first offshore wind project in Washington State.

The pace of progress accelerated throughout Europe as well. Construction of the 88 MW Hywind Tampen floating project began in late March, around 140 kilometers off the Norwegian coast. The project will consist of 11 SGRE-8 MW wind turbines mounted on concrete spar-type floating foundations at ocean depths of between 260 and 300 meters. It is estimated that the $518 million Hywind Tampen project will be fully operational by the end of 2022, making it the first floating offshore wind project to offer dedicated renewable electricity to oil and gas sites.

In any case, bigger initiatives are in the works. Beginning in January, EDF Renewables and DP Energy worked together to investigate the feasibility of implementing the 1 GW Gwynt Glas project in the Celtic Sea. Meanwhile, Denmark’s RST purchased a controlling stake in Scotland’s Salamander floating offshore wind development project, anticipating high demand for this type of wind power.

The French companies Ocean Winds and Banque des Territoires signed a port services agreement with Euroports in March for the 30-MW Eoliennes Flottantes du Golfe du Lion (EFGL) pilot project, which will feature three 10-MW turbines mounted on Principle Power’s WindFloat semi-submersible floating foundations. GreenIT, a partnership with End subsidiary Plenitude and CI IV, a firm run by Copenhagen Infrastructure Partners, agreed in April to construct two 750-MW floating offshore wind farms in the Mediterranean Sea off the coasts of Sicily and Sardinia. In April, Repsol of Madrid and Rsted of Denmark struck a deal to investigate potential floating offshore wind projects in Spain. There may be more projects in Spain now that the nation has released its draft “Marine Spatial Plan and Marine Energy Roadmap 2021.”

The floating offshore development in Asia is also gaining momentum, supported by the region’s leading oil and gas companies. Two electricity business licenses were granted by the Ministry of Trade, Industry, and Energy in March for the 1.3-GW MunmuBaram project off the coast of Ulsan by Shell Gas & Power Developments and CoensHexicon. The companies had previously signed an agreement with Korea Southern Power Co., a power generator. Also, in Japan, companies like Aker Offshore Wind and Mainstream Renewable Power have been working on getting an 800-MW floating project off the ground.

Conclusion

There was no attempt to rule out the need for additional empirical studies and monitoring of the environmental implications of deepwater, floating OWFs in specific locations and on specific species. Instead, the goal of this literature review is to bring together the information we already have so that we can better figure out how operating deepwater, floating OWFs may affect the physical and biological marine environment.

FAQ

What is “floating offshore wind”?

Floating offshore wind, in contrast to conventional offshore wind farms, is built on mobile platforms rather than permanent ones and so offers novel possibilities and choices. So, wind turbines can be put in offshore areas that are wider and deeper and have more wind potential. This opens the door to sites farther offshore.

How does a floating offshore wind turbine work?

Similar to how a floating oil platform is secured to the ocean floor by a network of mooring lines and anchors, floating turbines are anchored to the bottom of the ocean. Motion controllers on floating wind turbines keep the turbine steady by adjusting the blades. This makes the turbine more efficient and reduces wear and tear on the tower, foundation, and moorings.

Where is floating wind being used?

Off the coast of Norway, the “biggest floating wind farm in the world” has reportedly begun generating electricity. On Sunday, the first wind turbine owned by Norwegian energy company Equinor began generating electricity. Equinor’s renewable energy will support North Sea oil and gas activities.

You May Also Like

- World’s First Floating Wind Farm Performing Well Beyond Expectations

- Google Buys 43MW of Wind Energy While Saving Birds

- The Long Road to Vertical Axis Wind Turbines (VAWT)

- Wind Turbines Speed: Are They Supposed to Spin Fast All The Time?

- Windmill vs. Wind Turbine: What’s the Difference?

External Links

- Floating offshore wind: what future?

- How floating wind took over the renewable energy conversation

- Ten new technologies to electrify the future: Floating offshore wind and solar

- Potential environmental effects of deepwater floating offshore wind energy facilities

- Expanding Offshore Wind to Emerging Markets